The West Philadelphia community is criticizing Penn’s relationship with the city and asking the University to do its part.

Community members and organizers from Philadelphia Jobs with Justice held a community forum on Saturday titled ‘Is U. Penn Paying Its Fair Share?’. The resounding ‘no’ was clear from those who spoke to the 40 in attendance.

The main issue raised was Penn’s lack of Payment in Lieu of Taxes to the city.

PILOT contributions are the payments that groups who are exempt from paying property taxes voluntarily make to local governments to cover costs of essential services such as police and fire forces and road construction.

Penn was previously involved in a PILOT agreement with the city from 1995 to 2000, but it was not renewed after that period.

Executive Director of Public Citizens for Children and Youth Donna Cooper, a 1987 Fels Institute of Government graduate, spoke at Saturday’s forum.

“If they could pay $1.8 million dollars for taxes then, they can certainly afford it now,” Cooper said, citing Penn’s previous PILOT contributions and the University’s growing financial status since then.

The call for Penn and other nonprofit organizations around the city to reinstate these payments has been building for the past few years since the revenue from PILOTS fell from $9 million in 1995 to just $687,000 in 2009.

PILOT contributions fell after the passing of Act 55 in 1997 by the Pennsylvania General Assembly which clearly explained how to obtain tax-exempt status in the state.

Because local property taxes are used to fund schools, new appeals for Penn to contribute payments accompany possible solutions to the Philadelphia School District’s current financial shortfalls.

Penn asserts that its contributions to the City of Philadelphia and the surrounding neighborhood have a positive impact.

According to an email from Associate Vice President of University Communications Phyllis Holtzman, the University annually contributes $800,000 to the Penn Alexander School. She also argued that the University saves the city millions through the work of Penn’s 116-member accredited police force.

Today, Penn and Columbia are the only two Ivies that do not pay PILOT contributions to their local governments.

“Institutions that pay PILOTS are mostly in cities or municipalities that have a much greater reliance on property taxes and no comparable city wage tax like in Philadelphia.” Holtzman wrote in reference to the fact that the University’s employees pay over $140 million to the city’s general fund from their paychecks.

Penn Political science lecturer Mary Summers spoke at the forum and encouraged Penn to restore PILOT contributions. Summers said she hoped this type of forum was the beginning of a movement “to save the soul not only of Penn, but [of] higher eds around the country.”

Last year, Penn and 11 other area institutions of higher education released a report citing the ways the universities benefit the city financially in other aspects.

Summers cited this report in reference to the hourly wage estimation of the time volunteers spend in the community, and she and claimed that the University overestimates its contribution.

Penn maintains its significant community involvement, mentioning the $1 million they contribute annually to the Netter Center for Community Partnerships as well as the Penn Summer Scholars Program that gives high-achieving Philadelphia high school students the opportunity to attend a three-week program at the University tuition free.

Speakers at the meeting mentioned that Penn takes advantage of services the city provides like snow plowing and trash collection.

The University countered that Penn contributes $2 million to the University City District, a collaboration between area institutions, businesses and residents that provides services like street cleaning and trash removal.

“As the largest contributor to UCD, these programs would not be possible without Penn’s support,” Holtzman wrote.

Cooper argued that neither she nor anyone in attendance at the forum are excused from their property taxes based on the good things they do in their community, like volunteering or donating money to charity.

“Why would we allow any institution to make its own decision about what it thinks is the common good and deduct that from their tax payment?” she asked. “That’s anarchy.”

Summers called for, “respectful, reciprocal relationships” between communities and universities — “not ones where they’re deciding how to create partnerships,” she said.

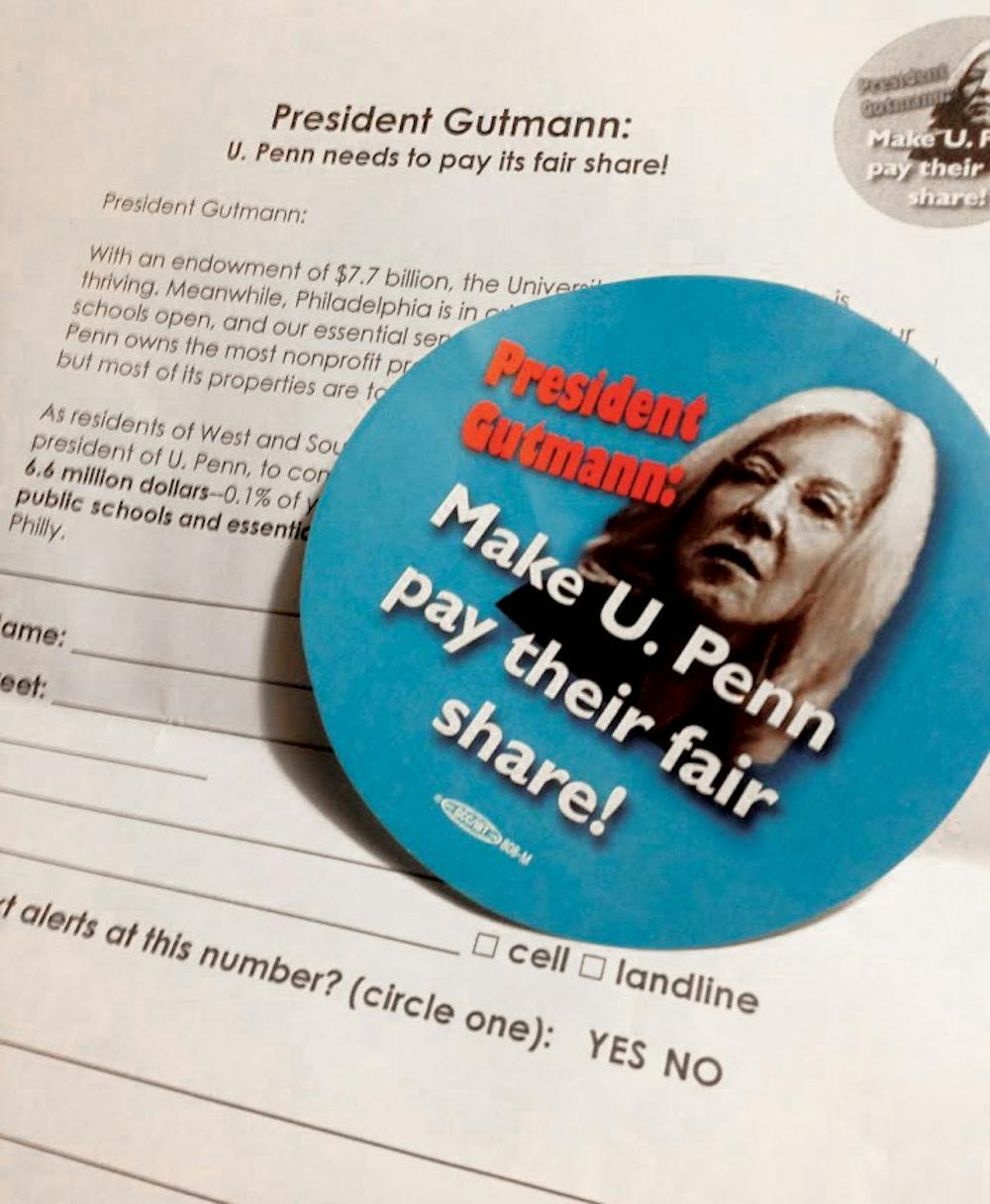

Attendees of the meeting split off into groups to discuss reactions to the speakers and brainstorm ideas. They were encouraged to sign a petition backed by Philadelphia Jobs with Justice aimed at Penn President Amy Gutmann requesting that Penn commit $6.6 million annually in payments to the city.