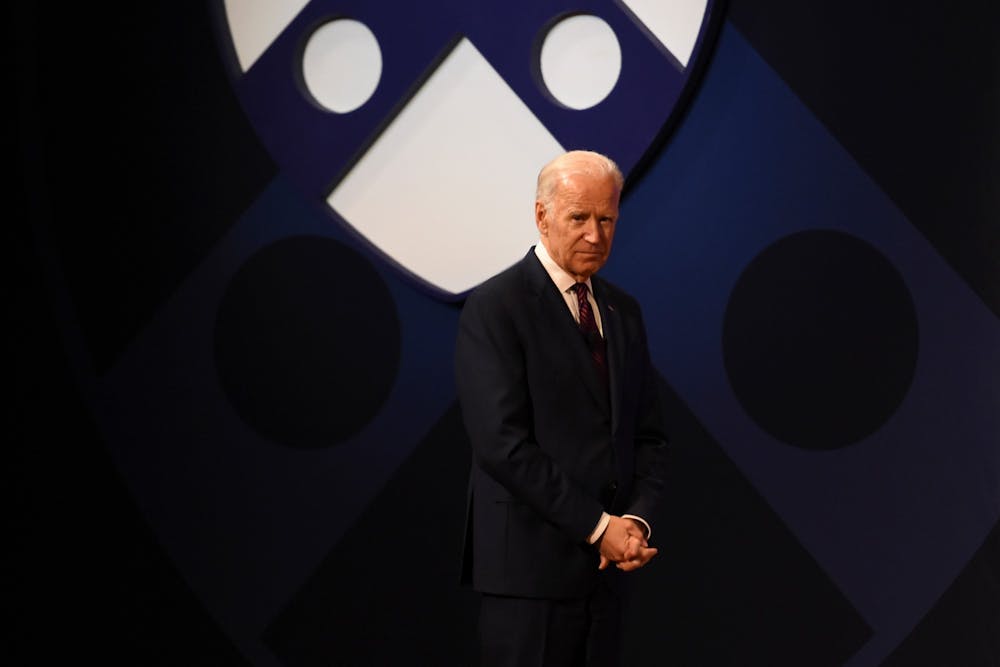

Despite garnering widespread backlash from college students and progressives, President Joe Biden’s statement that he will not consider a plan that favors loan forgiveness for students who attend elite institutions like Penn, Harvard University, and Yale University was met with agreement and understanding from some Penn professors.

In response to a question at a Feb. 16 town hall if he would consider a larger plan to forgive at least $50,000 in student debt, Biden replied that he “will not make that happen" — drawing confusion and anger from those who had hoped the president would take a more active role in canceling debt. Yet experts maintain that those who graduate with the highest amount of student loan debt often end up with higher earnings after graduating from four-year university programs, and they believe that Biden should prioritize other policies that target wealth inequality more directly.

Assistant professor of Business Economics and Public Policy Ben Lockwood said that there may be a more productive way to spend the $50,000 allotted in Democrats’ proposed loan debt forgiveness plan. Child allowances, direct income support, or college subsidies from the front end are all interventions he said could help people in a more progressive manner.

Former director of the Institute for Research on Higher Education and Penn adjunct professor Joni Finney agreed, as she believes that Biden has other priorities such as instituting more funding for early childhood education.

Biden's higher education plans during his presidential campaign included policies to increase accessibility to two- or four-year institutions by making public colleges and universities tuition-free for all families with incomes below $125,000.

Finney said she sees merit in Biden’s hesitation in supporting a plan to forgive up to $50,000 in student debt, but emphasized that it is important to recognize which subset of students have the most student debt and which subset feels the burden of these debts the most.

Often times, she said, it is not those who are attending Ivy League institutions.

Across the country, about $1.6 trillion in federal student loans is owed by about 43 million borrowers, but it is estimated that no more than 0.3% of federal student loans borrowers attended Ivy League schools. The same estimate shows that 49% of borrowers — the largest share — came from public colleges.

RELATED:

Penn Wharton Budget Model predicts Biden relief package will increase GDP in 2021

Penn students of color want Biden-Harris administration ‘to prove whether they were all talk’

Sandy Baum, senior fellow at the Center on Education Data and Policy at the Urban Institute, said people need to view the issue of student loan debt in a more realistic and holistic manner. She added that it is essential that Biden does not implement regressive policies that mainly serve privileged members of society who graduated from prestigious colleges.

“What matters is how much [students] borrowed, how much income they have now, and how well-equipped they are to pay it back,” Baum said. “The truth is that most people who went to Harvard, Yale, and Penn are doing very well, and we should not be forgiving their debt. It's not because of where they went to college; it's because they're doing well now.”

Lockwood explained that the people struggling the most are not usually those who have the highest amount of student loan debt from attending costly schools, since they often end up with higher earnings because they graduated from four-year university programs.

People with “more modest loan balances,” who were not able to graduate or complete prestigious degrees, are more likely to be burdened by paying back student loans, Lockwood said.

Baum said that she understands Biden’s perspective and called a plan that would cancel $50,000 for everyone with student loan debt “a pretty inequitable and irresponsible idea.”

Student loan debt is disproportionately held by households in the top half of the nation's income distribution, according to Baum, and a third of borrowers owe no more than $10,000. These borrowers are the ones who are the most likely to default on their loans and struggle to make their payments.

Baum added that people need to take a step back when looking at these issues, and also advocate for medical and utility debt relief that is increasingly necessary amid the pandemic.

While Finney believes student loan debt is a serious issue, she said the government needs to focus on resolving the systemic issues that have caused this debt in the first place, in addition to aiding subsets of students by canceling some student loan debt.

“I worry about all this conversation about debt, to begin with, because it's not getting to the core problem,” Finney said. “We are having all this conversation on debt without saying why it is necessary for all of these young people to borrow this much money.”