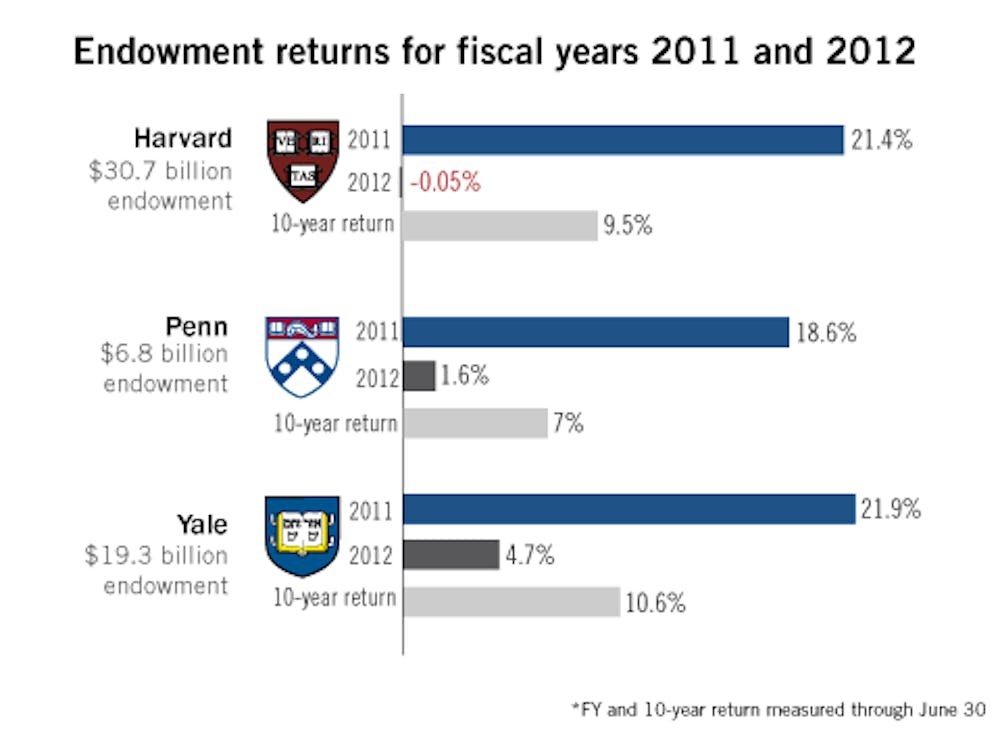

Penn’s endowment return for fiscal year 2012 has put the University in the middle of the pack of Ivies that have also announced their investment performance.

On the heels of Penn reporting a 1.6-percent investment return in FY 2012, Harvard University — whose endowment is the largest in the country — announced an investment loss of 0.05 percent.

The school’s endowment was valued at $30.7 billion as of June 30.

In contrast, Yale University posted a 4.7-percent return, ending FY 2012 with an endowment of $19.3 billion. The endowment decreased from the previous fiscal year’s value of $19.4 billion, as Yale’s spending exceeded its investment gains and new gifts.

Because Harvard and Yale have long held the two largest endowments for higher education institutions in the world, investment managers often look to the schools to gauge the progress of their own endowments year-to-year.

While other Ivies have not yet released their FY 2012 performance, Princeton University President Shirley Tilghman told Bloomberg News last month that she is expecting the school to see a return between 0 and 5 percent.

The Massachusetts Institute of Technology and Stanford University have announced returns of 8 and 1 percent, respectively.

Though Penn, whose endowment was valued at $6.8 billion as of June 30, produced a positive return, its FY 2012 performance marked a significant drop-off from FY 2011. In FY 2011, the University’s endowment saw an 18.6-percent return.

All three Ivies that have announced FY 2012 results have cited the uncertainty in global markets as a factor in the modest performances of their portfolios.

Though the Standard & Poor’s 500 stock index returned 5.5 percent for the fiscal year, the MSCI World index and MSCI Emerging Markets Free index saw drops of 14 and 16 percent, respectively.

According to Chief Investment Officer Kristin Gilbertson, all of the University’s asset classes posted positive returns, except international equities and emerging markets.

A Harvard press release reported that the school saw positive returns with its fixed-income assets and negative returns on public equities.

Penn’s investment portfolio consists more heavily of domestic equity, a more traditional endowment investment strategy, than those of Harvard and Yale. At the close of FY 2011, the last year for which data on Penn’s asset allocation is publicly available, domestic equity comprised 25.6 percent of Penn’s main portfolio, as opposed to 6.7 and 11 percent for Yale and Harvard, respectively, at that time.

Looking more long-term, Penn’s endowment has produced an average annual return of 10.7 percent over the last three years and 7 percent over the last decade. In comparison, the 10-year annualized returns for Harvard and Yale were 9.5 and 10.6 percent, respectively.

While Wharton finance professor Christopher Geczy said the asset allocations of Harvard and Yale that have tilted toward alternative strategies may have led to the differences in this year’s performance, it could have been due to merely luck as well.

“Anything can happen in one year,” he said. “In a given year, you can have two funds that do the same thing, same allocation and it can be a difference of luck or a difference of allocation.”

He added that Penn’s returns, relative to its peers, were not shocking given the economic environment.

“There’s nothing in the endowment returns to be displeased about,” he said.

Executive Vice President Craig Carnaroli agreed, adding that the endowment is managed for the long term.

“[The numbers] suggest that we’re maintaining the purchasing power of the endowment and it really should be valued over the long run,” he said. “We’ve stayed consistent with our strategy and we continue to have the ability to make good investments given the excellent fundraising that goes on … I don’t think there’s any concern over a one-year number.”

The Daily Pennsylvanian is an independent, student-run newspaper. Please consider making a donation to support the coverage that shapes the University. Your generosity ensures a future of strong journalism at Penn.

DonatePlease note All comments are eligible for publication in The Daily Pennsylvanian.