Although Penn’s fiscal year 2012 endowment return was much less than last year’s, it appears to have emerged as a relatively strong performer in the broader world of higher education.

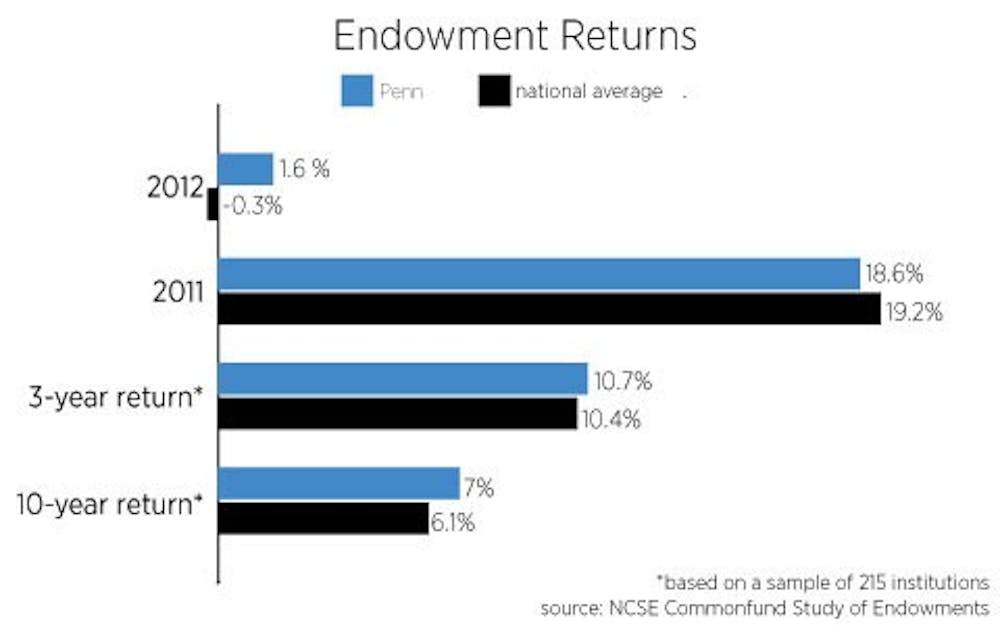

The National Association of College and University Business Officers and the Commonfund Institute recently released a series of preliminary findings that showed an average investment loss of 0.3 percent for 463 colleges and universities nationwide in FY 2012. Penn, on the other hand, saw a 1.6-percent investment return for FY 2012, which ended June 30, 2012.

The annual survey, which will include more than 800 institutions in its final report, saw a 19.2-percent average investment gain in FY 2011. Similarly, Penn’s return was 18.6 percent in this time period.

In multiple interviews with The Daily Pennsylvanian since Penn announced its investment returns in late September, former Chief Investment Officer Kristin Gilbertson, who announced her decision to step down last month, attributed the modest results to the eurozone crisis.

“The return is not inspiring, but it should not be unexpected, given what happened in global equity markets for the fiscal year,” said Gilbertson, who will continue to serve as a special adviser through the end of the year while the University searches for a new CIO. “We’re going to be in the middle of the pack — at or above median with our returns. Everyone is struggling in this environment.”

Executive Vice President Craig Carnaroli agreed, adding that these numbers should not affect Penn in the long run. He did acknowledge, however, that should the investment performance continue in this direction, it may hinder the University’s ability to spend the same rate of endowment funds in its budget.

The study also found that schools with the largest endowments — those greater than $1 billion — were the most successful, with an average return of 1.2 percent in FY 2012.

The smallest endowments — those under $25 million — also weathered the economic climate with an average gain of 0.2 percent. The mid-size endowments, however, posted negative returns.

Related

10/28/12 Board of Trustees convenes to discuss finance, academic policy, expansion

10/15/12 Penn chief investment officer to step down

10/7/12 Penn endowment return falls in the middle of other Ivies

NACUBO President and Chief Executive Officer John Walda and Commonfund Institute Executive Director John Griswold spoke to the historic success of larger endowments in a joint statement.

“This pattern [of larger endowments’ higher performance] was interrupted in the financial crisis of 2007-09, when smaller institutions tended to outperform owing to their larger allocations to fixed income and short-term securities,” they said. “This was short-lived, however, as larger institutions have produced the best returns over the FY 2010-FY 2012 period.”

The report also included data showing how some larger schools have been moving to alternative investment strategies over the last decade. Alternative strategies accounted for 59 percent of investment assets for institutions with endowments greater than $1 billion.

Penn’s endowment remains centered around public equity and absolute return strategies, which account for 45 and 23 percent of the investments, respectively. Gilbertson said in an email that Penn has been strategically diversifying its portfolio.

“We have been investing in real estate, natural resources and private equity in a systematic way since I arrived at Penn in 2004,” she said. “We have grown that portfolio from 6 percent of the endowment to 18 percent today. That is a significant increase; however, our allocation to illiquid alternatives is still less than that of our peers.”

The endowment returns of Penn’s peer institutions also declined significantly from those of the previous fiscal year. Harvard University’s investments had a return closer to the national average — a loss of 0.05 percent. With a 5.8-percent return, Dartmouth College was the top performer among Ivy League institutions that have released results.

While Penn is optimistic for the future, some experts remain wary about whether university endowments will see overwhelmingly strong performances in the near future.

“There are certainly enough question marks in the global economic picture that we’re cautiously optimistic but not expecting a very robust market,” Griswold said.