Top universities across the country want to make themselves accessible to low-income students.

And it seems the increasingly popular way of doing so is with a bold appeal to families whose income fall below a set level.

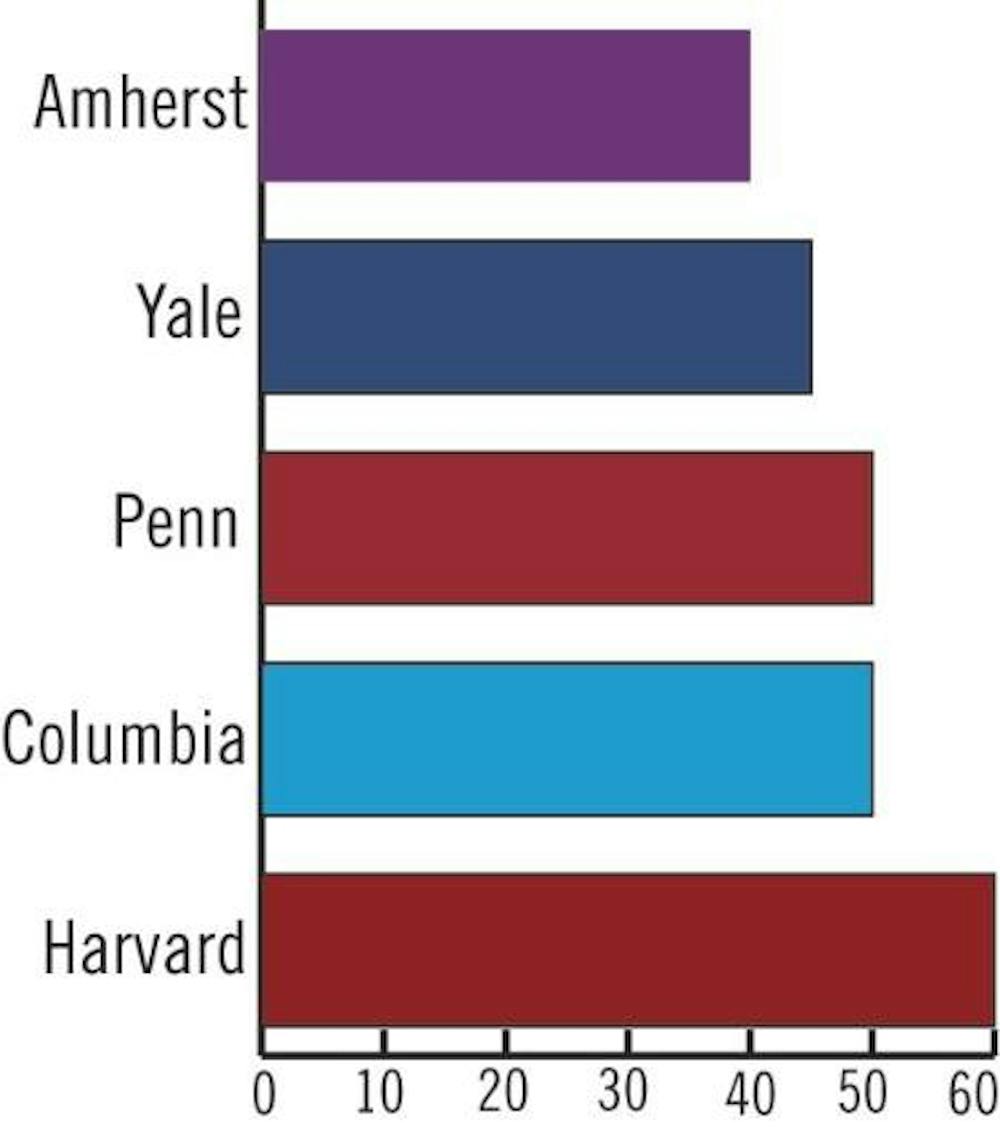

Columbia University is the latest school to jump on this financial-aid bandwagon. Last week officials decided that all students whose families earn less than $50,000 will receive no loans in their financial-age packages.

The decision is part of a wave of similar policy changes in which top-tier universities have been offering significantly more generous financial-aid packages.

Officials explain this trend both as a response to increasing numbers of college applicants from low-income families and the need to increase socio-economic diversity on elite campuses.

"There is a larger problem, and this is how those particular Ivy League schools have been able to respond," said National Association of Independent Colleges and Universities spokesman Tony Pals. "It's obviously in a very bold fashion."

He explained that, aside from the increasing number of low-income applicants, the maximum government-issued Pell Grant a low-income student can receive is $4,050 - and that figure has remained steady for the past five years, despite increases in tuition.

"Institutions are finding themselves in a position that they need to fill that gap [between the Pell Grant money and tuition costs] as quickly as they can in order to ensure that students can attend," Pals said.

And increasingly, schools are trying to close the gap between cost and ability to pay. Penn itself changed its financial-aid package last spring, offering loan-free packages to students whose families earn less than $50,000 per year.

Harvard and Yale both offer a financial-aid package that require no parental contribution for students whose families earn under $60,000 and $45,000 a year, respectively.

Penn officials agreed that the need for better financial-aid packages is pervasive in higher education.

"It is certainly something that is on the minds of a lot of people," Penn Director of Financial Aid Bill Schilling said. "Anything like this that may help those students is a good thing."

University President Amy Gutmann applauded Columbia for its new package, praising the increased publicity for need-based aid.

"The trend of the past two decades has been for merit-based financial aid," she said. "And that is counterproductive."

Schilling added that he does not believe Columbia's new package will have a direct effect on Penn's ability to attract low-income applicants.

It is still too early to know how Penn's new financial-aid package will affect applications, he said, since the change was just announced last semester. However, he said Harvard indicated that the school has seen some growth in its low-income applicant pool.

According to Columbia's financial-aid office, the change will affect about 14 percent of the university's college and engineering students.

Another important step in the right direction may involve getting the word out about financial-aid options, Schilling said.

"There are . issues of affordability and perceived affordability," Schilling said. "The two are not necessarily the same."