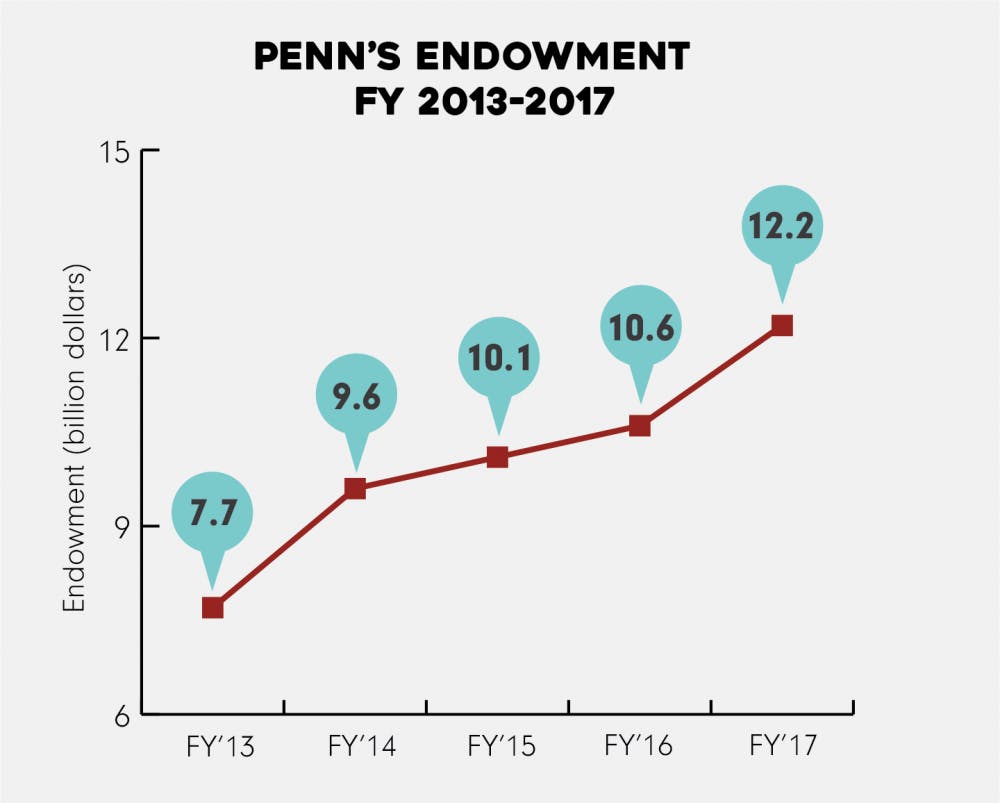

Penn reported a 14.3 percent investment return on its endowment, bringing the endowment’s total value to a record-high of $12.2 billion this fiscal year.

With Penn’s ranking as the eighth richest university in the world, its vast financial resources are always a topic of discussion within the world of higher education.

In 2017, the University’s endowment reached an all-time high, making it one of the best years for investment returns in Penn’s history. While experts say this spike in returns will have little impact on University spending, the controversy that erupted over a series of leaked documents known as "The Paradise Papers" in November placed the financial maneuvering of various elite universities in the spotlight — Penn included.

Federal and state policies from the new Trump administration also brought increased attention to Penn’s finances this year. In early 2017, Penn faced a $30 million funding cut when Gov. Tom Wolf (D-Pa.) proposed large budget cuts that would eliminate all state funding for Penn’s School of Veterinary Medicine. Just as this proposal was reversed in October, the new GOP tax plan began introducing a range of concerns for other members of the Penn community.

Now in December, the University continues to face many unanswered questions about its investments and how they will hold up against shifting federal guidelines. To understand how Penn is moving into 2018 as a financial entity, here is a guide to the year’s most important milestones in University finances.

Penn had one of its most successful financial years

The University’s multi-billion dollar endowment, the main source of school funds, reached new heights in the 2017 fiscal year. Penn reported a 14.3 percent investment return on its endowment, bringing the endowment’s total value to a record-high of $12.2 billion.

These high returns were largely driven by equity investments, which refers to the buying and selling of shares of stock on the stock market — but the larger endowment is unlikely to change University spending for 2018. Penn administrators and experts noted that one good financial year would not alter parts of the institution’s operating budget, which suggests that funds impacting students directly like financial aid will not be changing.

Students and experts criticized the University for how it allocates its money

Penn’s successful returns on its endowment were paired with new questions on how this money was being spent.

Fossil Free Penn, a campus organization pushing for the University’s divestment from fossil fuels, took new steps in their activism this year. In February, the group wore surgical masks at its demonstration at a University Council Open Forum before staging a multiple day sit-in in March in College Hall that gathered over 100 people and ended with the Office of Student Conduct citing 13 students.

Despite the multiple protests, the University did not respond to FFP, prompting the group to reorientate its strategy from "inflammation" to recruitment and education in the fall. While the shift has expanded the membership of the group, it has not led to tangible policy change from the administration. FFP leaders say they will continue to work on refining their approach in the new year.

Students aren't the only ones calling attention to Penn's investments. The investment techniques of large universities like Penn became a topic of national discussion with the release of “The Paradise Papers” — a collection of more than 13 million documents revealing that Penn was among dozens of universities to store millions of dollars in offshore tax havens.

The University’s tax forms revealed four funds in the Cayman Islands where Penn has stored more than $80 million dollars. These offshore private accounts, while riskier than government equities that universities have traditionally placed their money in, can also be much more lucrative, bringing higher returns for Penn.

Penn actively worked against state and federal policies that affected its finances

As a private institution, Penn is less swayed by government higher education decisions than public institutions. Nonetheless, major state and federal policy changes presented a range of concerns for University administrators in 2017.

When Wolf announced sweeping cuts to state funding for universities in February, the University found itself at risk of losing almost $30 million for Penn Vet, 20 percent of the school’s budget. After months of uncertainty, which sparked outrage from veterinary students and faculty, Wolf signed a bill allocating state funding for Pennsylvania schools and alleviating Penn Vet’s financial stress.

However, just weeks after, new concerns arose around the new GOP tax bill which has officially passed the House of Representatives and the Senate. Both bills propose a 1.4 percent excise tax on private universities’ endowments. This means Penn’s highest paid employees, like Penn President Amy Gutmann whose pay totaled $3.5 million, could also stand to lose large parts of their income under the new proposal.

The version of the bill that passed the House also includes several provisions that could significantly increase the price of a graduate education, prompting protests from students across the country, including at Penn. Dozens of graduate students marched into College Hall in November calling on Gutmann to "protect" them from the repercussions of this bill.

In the coming weeks, state representatives will head to a conference committee to solve the differences between the House and the Senate proposals of the GOP tax plan. Given the potential repercussions of the plan, many members of the Penn community will be looking to University leaders to exert their influence on the legislation.

In April, reporting from The Daily Pennsylvanian showed that Penn spends over $1 million each year trying to influence legislation on the state, local, and national level, which is almost twice as much as any of its peer institutions.

The Daily Pennsylvanian is an independent, student-run newspaper. Please consider making a donation to support the coverage that shapes the University. Your generosity ensures a future of strong journalism at Penn.

Donate