University Director of Financial Aid Elaine Papas Varas believes the disablement of the data tool will not make the financial aid forms significantly more difficult to complete.

Credit: Gisell GomezApplying for financial aid often feels overwhelming to many Penn students — and it may have just gotten harder.

The Internal Revenue Service Data Retrieval Tool, an online resource that allows Americans to upload tax-return information without having to manually enter it, has been disabled until October due to security concerns. Hackers attempted to use personal information from the tool to file fraudulent tax returns, according to The Washington Post.

College senior Sam Murray, the undergraduate chair of the Student Financial Services Advisory Board, said that the aid application process will likely be less streamlined as a result of the tool being out of service. However, Murray feels that the Department of Education and the IRS’s decision to take the tool down completely was “probably well-advised, given the circumstances.”

“Obviously we’re not happy that they couldn’t have been more proactive about getting it back up sooner or knowing that this data breach could have happened earlier,” he said.

Murray added that Student Registration and Financial Services is working to make sure everyone is aware of the tool’s disablement.

“Hopefully we won’t let this affect people negatively. There will be some issues for certain, but I think that we’re prepared to deal with them.”

University Director of Financial Aid Elaine Papas Varas said she feels the disablement of the IRS tool will not make applying for financial aid any harder for families.

“We’ve only had the DRT service available to us for the last two years,” she said. “So before that, families didn’t have the ability to tap into the IRS.”

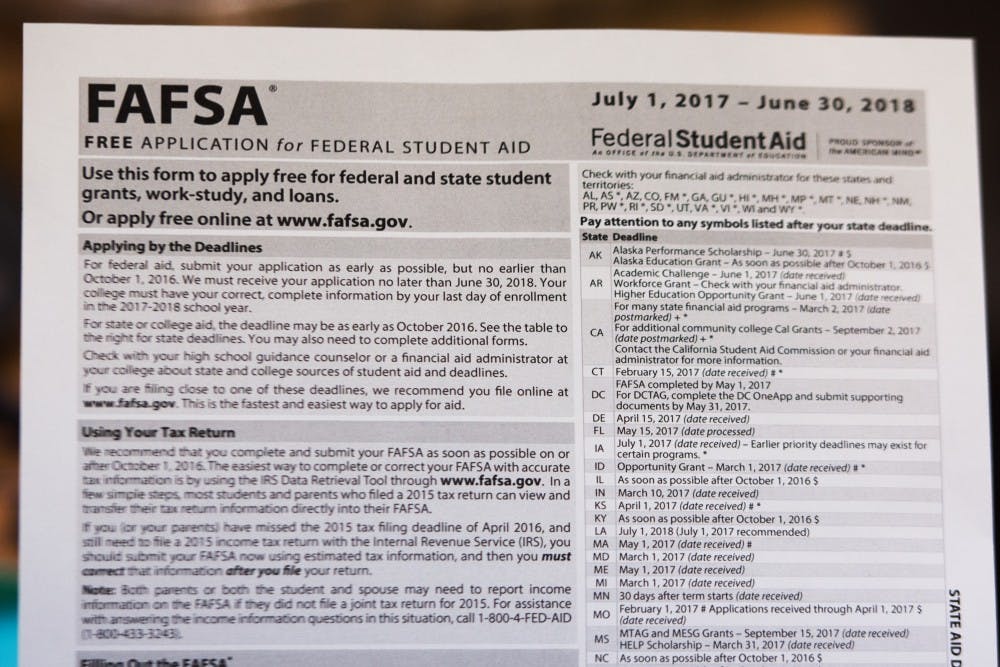

Papas Varas said SRFS will go back to the way it processed funding in the past, which involved “families filling out the FAFSA, filling out their profiles, putting either estimated or actual on the tax returns on their form, and submitting tax returns.”

“The federal government was very resistant to allow the Department of Education to tap into the IRS — you can imagine why. Because the IRS is very protective of their data, obviously,” she said.

Papas Varas noted that since the DOE was able to establish a secure link with the IRS two years ago, “we have had nothing but trouble.”

“The IRS got hacked last year,” she said. “[The data retrieval tool] is new, and it probably doesn’t have all the bugs out of it yet.”

Papas Varas advised families to try to submit their tax information to the IRS as early as possible and said that families should keep copies of their tax returns.

She said she believes that while the tool was useful for all students, it will not be any more difficult for families to apply for financial aid without it.

“As a taxpayer, I feel very comfortable that what they’re doing, they need to do,” she said. “As a director of financial aid, I feel very comfortable doing what they need to do. And as a student, I think that the students would want to know for sure that their tax information was secure.”

The Daily Pennsylvanian is an independent, student-run newspaper. Please consider making a donation to support the coverage that shapes the University. Your generosity ensures a future of strong journalism at Penn.

Donate