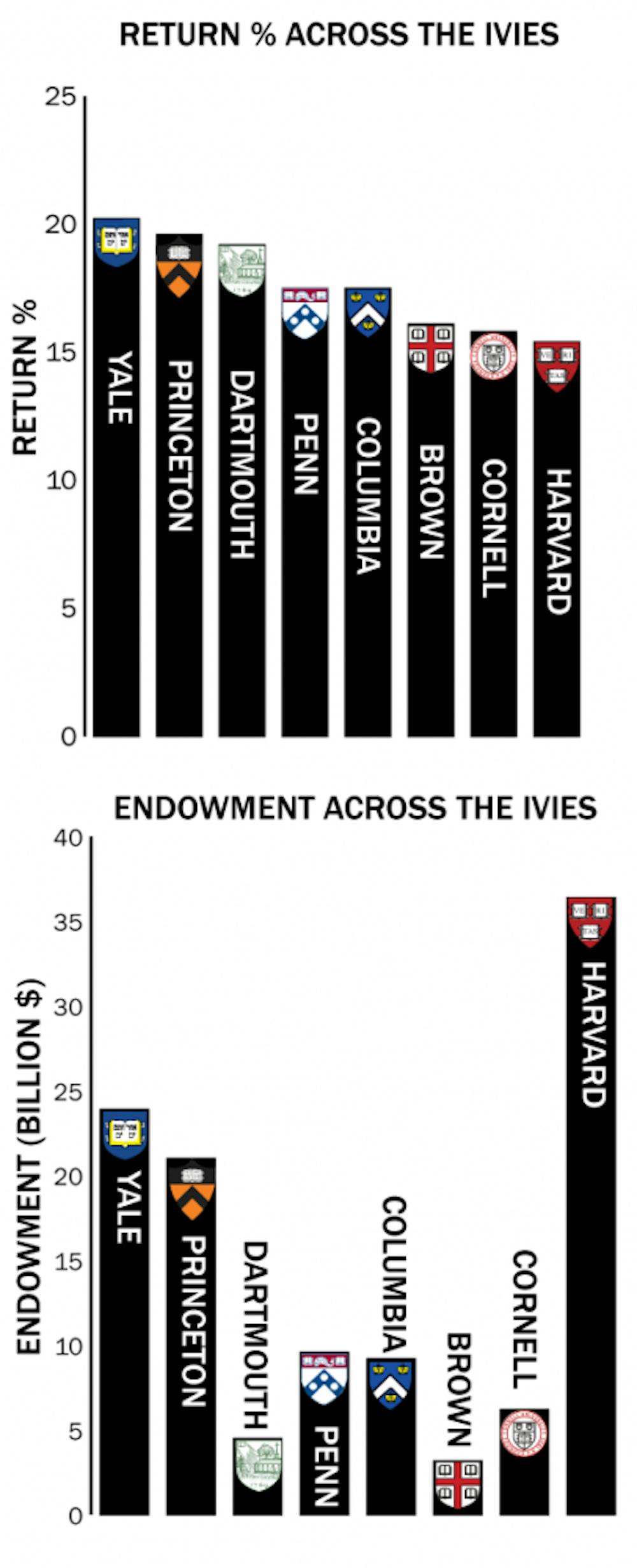

Penn’s endowment returns were just average compared to its peers during fiscal year 2014.

Penn led the Ivy League in investment returns during fiscal year 2013, with returns of 14.4 percent. The rest of the Ivy League averaged returns around 12 percent that year. This year, Penn is keeping pace with peer institutions, ranking fourth in investment performance.

Reporting returns of 17.5 percent for the year ending June 30, 2014, Penn still saw its endowment value climb to $9.6 billion, a record high for the University.

Boasting returns of 20.2 percent for the last fiscal year, Yale topped the Ivy League in investment performance, bringing its total endowment to $23.9 billion. Princeton University and Dartmouth College followed suit, reporting returns of 19.6 percent and 19.2 percent, respectively.

Penn and its peers’ endowment growths are unsurprising, given the success of public equity demonstrated by Standard & Poor’s 500 Index’s 24.6 percent growth in the fiscal year ending on June 30.

“We benefit from being able to take a time horizon longer than the vast majority of investors can,” Penn’s Chief Invest ment Officer Peter Ammon said. “No one knows what markets will do from day to day, or even from year to year, but by working hard to identify and partner with the best investment managers across the globe, we think we will be well-positioned for long-term success.”

Columbia matched Penn in investment performance, with returns of 17.5 percent, while Cornell and Brown reported returns of 16.1 percent and 15.8 percent, respectfully.

Despite the fact that Harvard’s $36.4 billion endowment is the largest in the Ivy League and in American higher education, the Cambridge institution saw the poorest investment performance in the Ivy League, with 15.4 percent returns.

In fact, Harvard is the only Ivy League institution to have yet to recover completely from the 2008 financial crisis, when the Dow Jones Industrial Average lost 33.8 percent of its value in a single year. Prior to the downturn, Harvard’s endowment was $36.9 billion in the 2008 fiscal year. Six years later, Harvard’s endowment sits about $500 million below its 2008 peak.

Ammon, who came from Yale in 2013, said that a school’s investment strategy should be one that can be successfully executed by its investment team.

“For example, a strategy that calls for manager selection in inefficient markets across the globe requires a significant commitment by the institution to building a deep investment office,” Ammon said in an email.

Larger endowments — those over $1 billion — tend to invest the majority of their funds in “alternative” investments such as commodities, private equity and real estate, according to Ken Redd , Director of Research and Policy Analysis at the National Association of College and University Business Officers . Smaller endowments — those under $25 million — invest the bulk of their assets in traditional stocks and bonds.

In terms of sheer endowment size, Penn’s $9.6 billion falls fourth on the list of Ivy League institutions, behind Harvard, Yale and Princeton. Until this year, Columbia’s endowment was larger than Penn’s as well.

Penn’s average return over the ten years ending June 30 was eight percent, placing the University toward the bottom of the Ivy League pack. Penn President Amy Gutmann has said that long-term returns are more indicative of endowment health than one-year returns.

The Daily Pennsylvanian is an independent, student-run newspaper. Please consider making a donation to support the coverage that shapes the University. Your generosity ensures a future of strong journalism at Penn.

DonatePlease note All comments are eligible for publication in The Daily Pennsylvanian.